3 Simple Techniques For Succentrix Business Advisors

3 Simple Techniques For Succentrix Business Advisors

Blog Article

Not known Facts About Succentrix Business Advisors

Table of ContentsSuccentrix Business Advisors Can Be Fun For EveryoneThe 7-Minute Rule for Succentrix Business AdvisorsGet This Report about Succentrix Business AdvisorsNot known Facts About Succentrix Business AdvisorsThe smart Trick of Succentrix Business Advisors That Nobody is Discussing

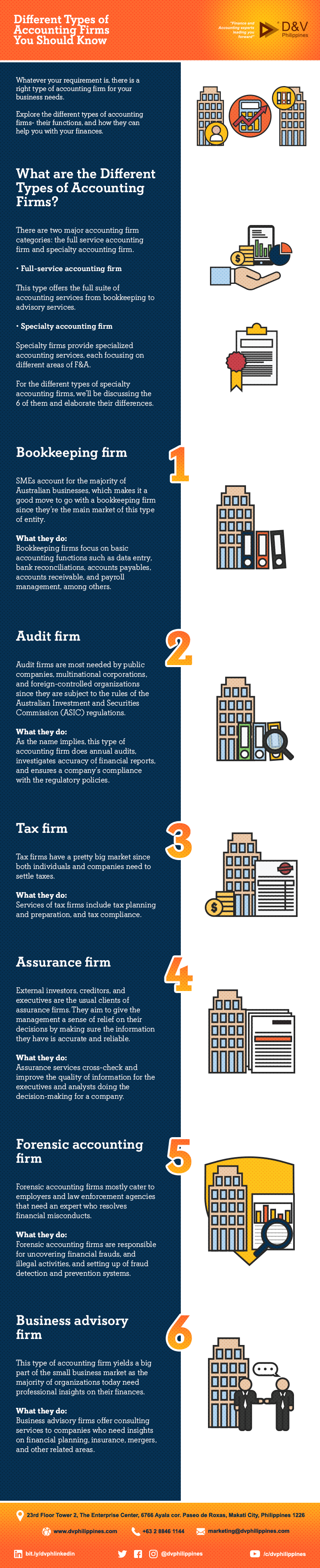

Getty Images/ sturti Contracting out bookkeeping services can maximize your time, protect against errors and also minimize your tax obligation costs. The dizzying range of options may leave you frustrated. Do you need a bookkeeper or a cpa (CERTIFIED PUBLIC ACCOUNTANT)? Or, maybe you desire to handle your basic accountancy jobs, like receivables, yet hire an expert for cash money flow projecting.Discover the various kinds of bookkeeping solutions offered and find out just how to pick the best one for your small company requirements. Bookkeeping services drop under basic or monetary accountancy. General bookkeeping describes normal responsibilities, such as tape-recording purchases, whereas economic audit strategies for future development. You can work with an accountant to enter data and run reports or work with a certified public accountant who supplies financial recommendations.

Prepare and file tax obligation returns, make quarterly tax payments, data extensions and manage Internal revenue service audits. Generate economic statements, including the balance sheet, revenue and loss (P&L), cash flow, and earnings statements.

The Facts About Succentrix Business Advisors Uncovered

Track job hours, compute earnings, withhold tax obligations, problem checks to staff members and make sure accuracy. Audit solutions may additionally include making pay-roll tax obligation payments. Furthermore, you can employ consultants to make and establish your bookkeeping system, provide monetary preparation suggestions and describe economic statements. You can contract out primary monetary police officer (CFO) services, such as sequence preparation and oversight of mergings and acquisitions.

Frequently, little service proprietors outsource tax services initially and include pay-roll support as their business grows., 68% of participants use an outside tax obligation practitioner or accounting professional to prepare their firm's tax obligations.

Develop a list of procedures and tasks, and highlight those that you want to outsource. Next off, it's time to locate the ideal bookkeeping company (cpa near me). Currently that you have an idea of what kind of accountancy solutions you need, the inquiry is, who should you hire to supply them? While a bookkeeper manages data access, a Certified public accountant can speak on your part to the Internal revenue service and offer economic recommendations.

The smart Trick of Succentrix Business Advisors That Nobody is Discussing

Before deciding, think about these questions: Do you desire a local accountancy expert, or are you comfy functioning virtually? Does your service need sector knowledge to perform accounting jobs? Should your outsourced services incorporate with existing bookkeeping devices? Do you intend to contract out human sources (HUMAN RESOURCES) and pay-roll to the exact same supplier? Are you looking for year-round help or end-of-year tax administration solutions? Can a service provider finish the job, or do you need a team of professionals? Do you require a mobile application or on the internet portal to oversee your bookkeeping services? CO aims to bring you ideas from leading recognized experts.

Apply for a Pure Leaf Tea Break Grant The Pure Fallen Leave Tea Break Grants Program for little businesses and 501( c)( 3) nonprofits is currently open! Concepts can be brand-new or already underway, can come from Human resources, C-level, or the frontline- as long as they boost worker well-being with society adjustment.

Something went incorrect. Wait a minute and attempt again Attempt again.

Advisors supply valuable insights into tax methods, guaranteeing organizations reduce tax obligation liabilities while adhering to intricate tax policies. Tax planning includes positive actions to optimize a company's tax placement, such as reductions, credit scores, and rewards. Staying on par with ever-evolving accountancy requirements and governing demands is crucial for businesses. Accountancy Advisory specialists help in monetary coverage, making certain accurate and certified economic statements.

All about Succentrix Business Advisors

Here's a thorough look at these essential abilities: Analytical abilities is a vital ability of Accountancy Advisory Solutions. You should excel in gathering and examining financial data, drawing purposeful insights, and making data-driven suggestions. These abilities will allow you to examine monetary performance, identify fads, and offer notified advice to your clients.

Interacting effectively to customers is an essential ability every accountant should have. You need to have the ability to communicate complex economic information and understandings to customers and stakeholders in a clear, understandable fashion. This includes the ability to convert monetary jargon right into plain language, create detailed reports, and deliver impactful discussions.

Facts About Succentrix Business Advisors Revealed

Accountancy Advisory firms use modeling techniques to imitate numerous economic scenarios, evaluate prospective end results, and support decision-making. Proficiency in economic modeling is crucial for accurate projecting and strategic preparation. As an audit consultatory firm you must be fluent in economic guidelines, accountancy criteria, and tax obligation regulations relevant to your customers' industries.

Report this page